On paper, a disability claim sounds easy enough. You are unable to work, you file a claim, and benefits show up to help cover the gap. In reality, disability claims are more like a detailed exam where every answer matters. Insurance companies review claims carefully, and even small mistakes can slow things down or stop benefits altogether. Knowing what not to do can save you time, stress, and more than a few deep sighs.

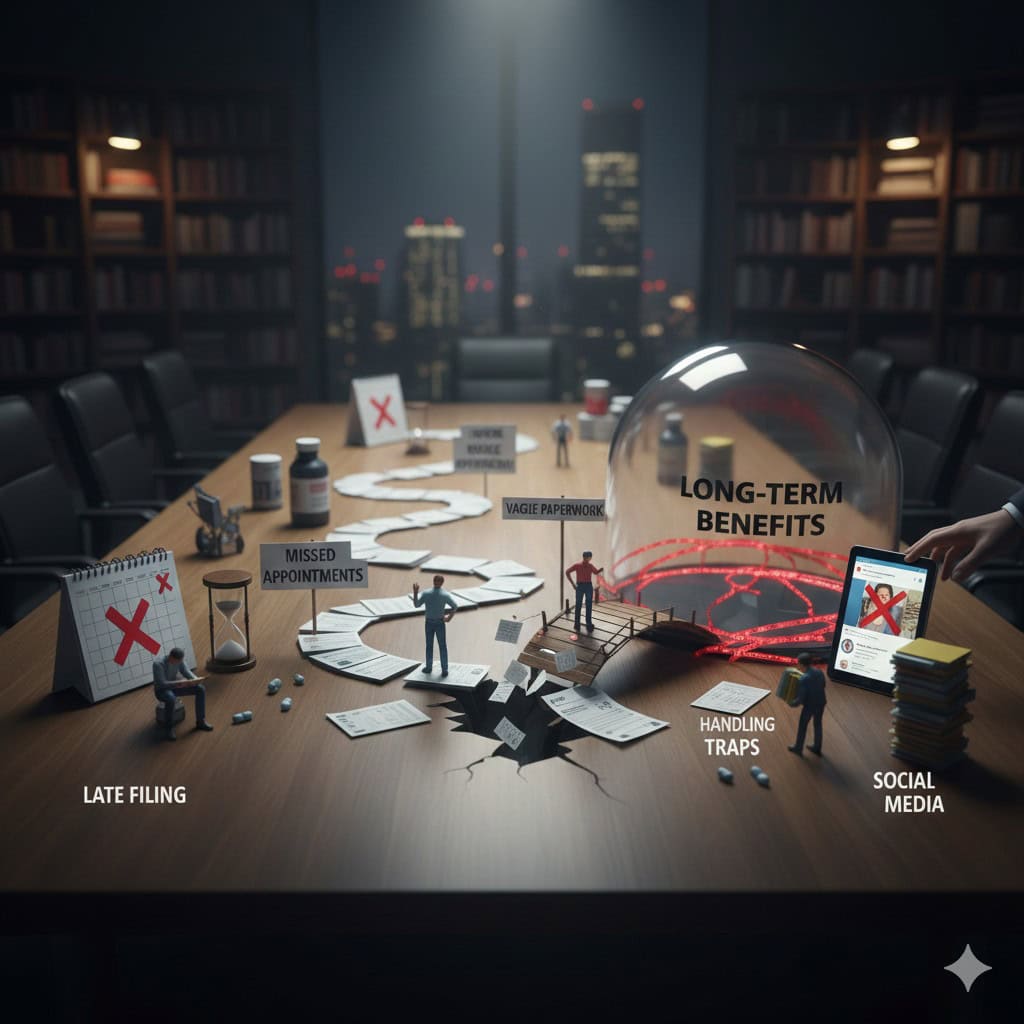

Waiting Too Long Because You’re Hoping for the BestMany people delay filing because they expect to bounce back quickly. Optimism is admirable, but insurance policies are not moved by good intentions. Short-term disability claims often have strict filing deadlines. Miss them, and benefits may be reduced or denied completely. Filing early and hiring a disability attorney gives you a safety net. If you recover sooner than expected, great. If not, you are already protected.

Skipping Appointments or Ignoring Medical AdviceDisability claims rely heavily on medical records. If you miss appointments, delay treatment, or ignore your doctor’s recommendations, insurers may question how serious your condition really is. Gaps in care can suggest that your limitations are not as severe as claimed. Consistent treatment shows that you are actively addressing your health. Insurance companies like patterns, and regular medical care creates the right one.

Being Too Vague on PaperworkPaperwork is rarely fun, but vague answers can cost you. Statements like “I can’t work” do not tell insurers much. They want details. How does your condition affect your daily tasks? What parts of your job can you no longer perform? The clearer you are, the easier it is for reviewers to understand your situation. Think less mystery novel and more instruction manual.

Assuming Your Job Title Explains EverythingInsurance companies do not automatically know what your job involves. A job title alone does not explain physical demands, mental focus, or long hours. If your role requires lifting, standing, decision-making, or constant attention, that needs to be spelled out. A detailed job description helps connect your medical limitations to your actual work. Without it, insurers may assume your job is easier than it really is.

Not Reading the Policy Because It’s BoringDisability policies are not thrilling reading, but skipping them can be costly. Policies define disability differently. Some focus on whether you can do your current job. Others focus on whether you can do any job at all. Understanding these definitions helps set realistic expectations. Knowing the rules makes it easier to meet them, even if reading the policy feels like homework.

Thinking Short-Term Approval Guarantees Long-Term BenefitsApproval for short-term disability does not automatically lead to long-term benefits. Long-term claims are evaluated separately and often require updated medical documentation. Many people are caught off guard by this transition and experience gaps in coverage. Preparing early by keeping records current helps prevent interruptions. Insurance companies love fresh paperwork, whether we like it or not.

Sharing Too Much OnlineSocial media can quietly complicate a disability claim. Insurers sometimes review online activity, and posts can be misunderstood. A photo from a good day or a short outing may raise questions about your limitations. Even innocent updates can work against you. During a claim, it is often best to keep posts limited or neutral. Less explaining later is always a good thing.

Trying to Handle Everything AloneDisability claims can feel overwhelming, especially when health is already a concern. Many people try to manage the process alone and miss important details. Reaching out to HR, benefits administrators, or professionals familiar with disability claims can help. Asking for help is not giving up. It is often the smartest step in protecting your benefits.

Protecting Benefits Takes PreparationShort- and long-term disability benefits provide critical support during challenging times. Avoiding common mistakes helps keep that support in place. Filing on time, staying consistent with care, and providing clear information all work in your favor. With the right approach, you can spend less time worrying about paperwork and more time focusing on recovery, which is exactly where your energy belongs.